Part III: Fundamental Rights

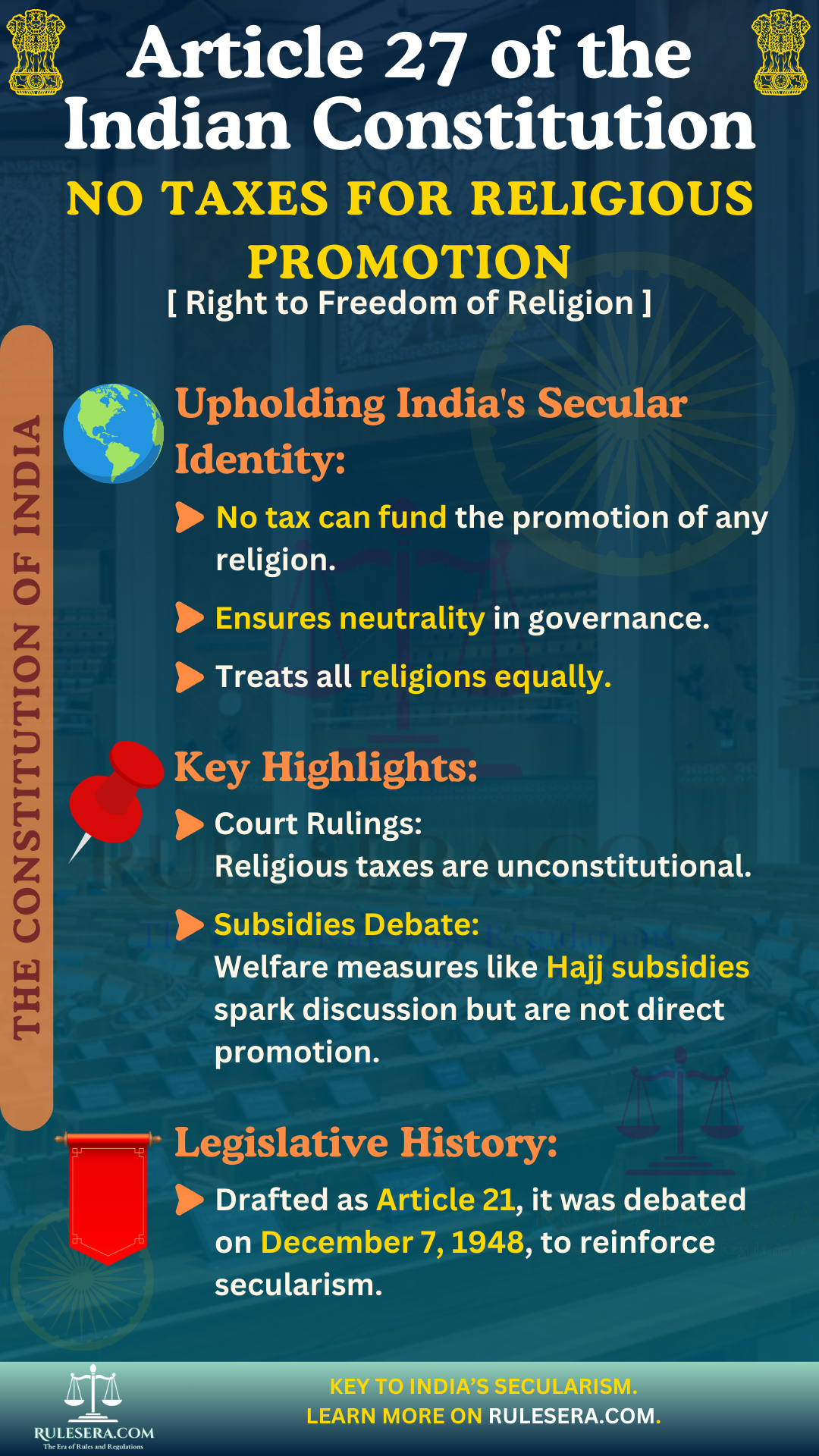

Article 27: Freedom as to Payment of Taxes for Promotion of Any Particular Religion:: Right to freedom of Religion

No person shall be compelled to pay any taxes, the proceeds of which are specifically appropriated in payment of expenses for the promotion or maintenance of any particular religion or religious denomination.

Explanation

Article 27 prohibits the state from compelling individuals to pay taxes that are used specifically for the promotion or support of any religion. This reinforces the secular nature of the Indian state, ensuring that public funds are not used to favor any particular religious group.

Key Aspects of Article 27

- Prohibition of Religious Taxes: Ensures that no tax proceeds are used for promoting or maintaining any religious institution, safeguarding state neutrality.

- Secular State Principles: Reinforces the secular character of India by prohibiting the financial support of religious activities through taxes.

Real-Life Applications

Debates over subsidies for religious pilgrimages, such as the Hajj pilgrimage subsidy, have sparked discussions regarding Article 27. While framed as welfare, such subsidies have led to questions about the state's role in supporting religious activities through taxpayer funds.

Frequently Asked Questions (FAQs):

Article 27 prohibits the state from using tax revenue for the promotion or maintenance of any particular religion or religious denomination.

No, taxes cannot be specifically appropriated for religious purposes. The government is required to maintain a secular stance when it comes to the use of public funds.

Pilgrimage subsidies, such as those for the Hajj, are debated under Article 27. While subsidies are framed as welfare measures, they have raised concerns about potential favoritism toward specific religious groups.